What is Finance:

Finance is defined as a body of facts, principles, and theories, dealing with the raising and usage of money by individuals, businesses, and governments. This is a broad term and is derived from the French word. To be more specific, it is a specialized study of how an individual and company manage their funds. Specifically, when the question comes to managing the assets, and liabilities of a company for a specified time duration. Likewise, it is defined as the management of money. Therefore, it is the study of managing money and finding the required funds or financial resources. Additionally, it includes matters such as creation, management, the study of money, investments, banking, assets, and liabilities.

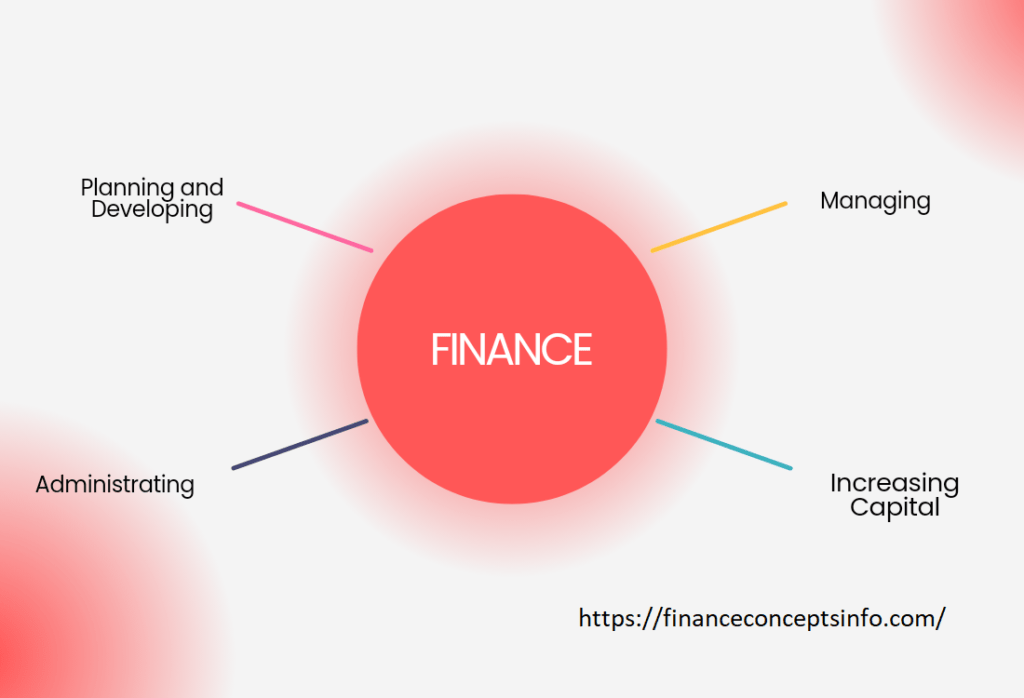

Consequently, it deals with many activities like investing, borrowing, lending, saving, budgeting, and forecasting. It is the process of raising funds for any type of work or expenditure. It is the system in which funds are exchanged between borrowers and lenders and investors. Additionally, it is also concerned with planning, developing, managing, administrating, and increasing capital used for any business and organization.

Purpose of Finance:

It is the process of raising funds or capital for any kind of expenditure. The purpose of Finance is to help people and organizations save, manage, and raise money. As we know that businesses need capital or funds to run their operations. They have to make smart and wise financial decisions and long-term strategies to achieve their desired goals. Furthermore, it is just like a road map that provides guidance, and directions to individuals, organizations, and governments so that they can make decisions and take necessary actions.

The other purpose is to provide verified information to organizations that are necessary for business planning and decisions. It provides various channels of funds in the form of loans, credit, and invested capital to economic entities. Economic entities use these funds when they are needed. They also use funds in the production of goods and services. As we know that businesses need funds or capital so it is the basic foundation of any business.

Importance of Financial Planning:

This is a field that deals with money matters. It is the most important factor for any individual or organization. It gives life to all the financial activities performed throughout the nation. In the absence of finance, nobody can imagine setting up their businesses. Individuals, organizations, and governments need funds to run their operations. With the help of funds, they can run their operations smoothly and effectively. It is important for the overall development of the economy. Corporates and Government entities spend a lot of energy on planning, budgeting, and then making decisions that are important for their growth and development. Without funds, an individual, corporations, and government entities cannot survive in the market. They need a proper channel to complete their tasks. Every department needs money or funds to accomplish its desired goals. So it is very important for all entities of the nation.

Types of Finance:

It is the study of managing funds. It is concerned with the process, institution, markets, and instruments involved in the transfer of money among individuals, governments, and businesses. These entities need funds to run their business operations. They cannot survive without funds or money.

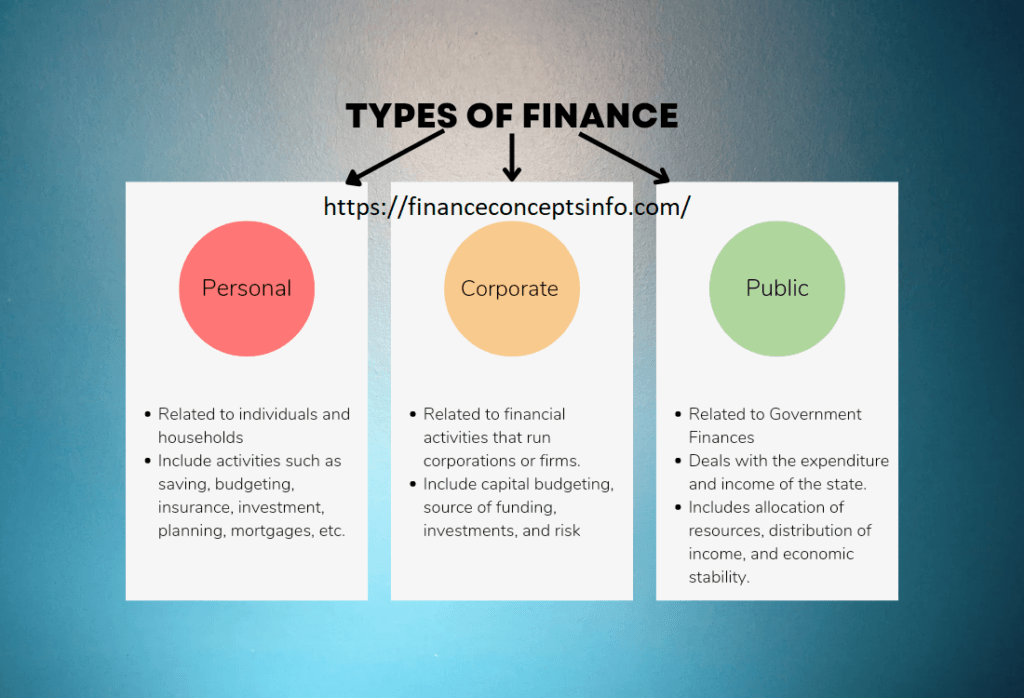

Finance has 3 main types:

- Personal

- Corporate

- Public

Personal Finance:

Personal finance is related to individuals or households. This Field helps to manage the funds of individuals or households and helps them to achieve their desired goals. Moreover, it defined all the financial decisions and activities of individuals. What’s more, it covers a wide range of activities such as budgeting, savings, insurance, and mortgages. Similarly, it includes various types of investments and planning that are related to individuals. As a result, it has strategies depending on the individual earning potential to achieve their goals, within a certain time frame. Thus, it helps individuals to manage their finances through the process of budgeting, spending, and savings for both the short term and long term. It manages the finances and funds of individuals and families of the whole universe. It also takes responsibility for an individual’s current situation and sets their financial goals.

Corporate finance:

Corporate Finance can be described as a funding source for a company to meet its expenses and can help a company to gain its capital requirements. Moreover, it refers to all financial activities that are associated with running corporations. Besides, it is a department or division that focuses on and oversees financial activities. Similarly, it also deals with sources of funds. As a result, it provides complete channelization for the disbursement of funds that can help to increase the financial worth of a company. It can also help to maintain a balance between opportunities and risks. It also focuses on maximizing the value of the company’s assets. In every organization, there is a separate department that manages and oversees the financial activities. The primary concern is to maximize shareholder value through short- and long-term financial planning and by implementing different strategies. It includes different tools that are used to prioritize and distribute financial resources. It includes capital budgeting, sources of funding, investments, risks, and profits.

Public finance:

Public Finance deals with the study of expenditure and income of the state. However, it only considers the government finances. Additionally, it includes the collection of funds and their allocation among different sectors of the state. Likewise, it manages the activities that perform essential functions and duties. Moreover, it is the approach to managing the public funds of the economy of the country. Consequently, it plays an important role in the development and growth of the nation both domestically and internationally. It may include payable tax to the government, spending on their day-to-day business operations, formulating budget for different projects, and can also be related to debt-issuance policies. All these activities can help the government to decide to formulate progressive projects for the well-being of the general public. In other words, Fiscal policy has a significant role in the development of planning these expenditures. Every country needs funds and money to run.

The country’s revenues are the collection of taxes and return on investments. All the revenues and expenditures are collected by or for the public. The government plays an important role to create a balance between income and resource distribution to create economic stability in a country.

Conclusion:

Finance plays a very vital role in all aspects of life. Financial understanding and planning play a vital role in our lives and workplaces. Without money or capital, an individual, corporation, or organization will not survive in the world. It is one of the core functions of any entity. An organization’s existence depends on how smoothly they run its financial activities to achieve its goals. Even governments are responsible to answer the question of the people on handling their financial matters.