What is Corporate Finance?

Corporate finance is the management of a company’s money. It includes making decisions about how money should be invested. Professionals in corporate finance look at investment possibilities. Additionally, they also raise funds and deal with risks.

The goal is to increase the profits for the shareholders. Companies want to get the most out of their resources. This helps them to create value. Moreover, experts in corporate finance use different methods to reach this goal. They help companies make investment decisions. They also make budgets and sell stocks and bonds to raise funds.

Importance of Corporate Finance:

Corporate finance is essential for the success of an organization. There are several reasons for that:

- Capital Allocation: Corporate finance helps businesses decide where to put their money. This is important to maximize the value for shareholders. Moreover, experts also tell businesses how to use their money best. They look at the cost of capital and compare it to the possible investments.

- Risk Management: The success of a business depends on how well it can handle risks. Hence, experts in corporate finance use their skills in this regard. They know how to analyze and deal with all kinds of risks.

- Financial Planning And Analysis: Corporate finance helps businesses make plans for their money. This is important if they want to meet their long-term goals. Corporate experts find chances for growth. They look at financial facts and resources to make decisions. So they can make better choices about future investments.

- Fundraising: For a business to grow and do well, it needs money. Finance experts deal with banks and other financial organizations. Om this way, they help companies get the money they need.

- Mergers and Acquisitions: Corporate finance is a key part of figuring out whether a merger or acquisition is a good idea. Professionals can also help companies determine which of these choices is best. They look at financial info and records. This way, they can weigh the pros and cons of the deal.

Types of Corporate Finance:

Let’s have a look at the two major types of corporate finance:

Equity Financing:

Equity financing includes selling stocks to increase the company’s capital. Typically, capital is exchanged in the form of equities or shares. Additionally, the company doesn’t have to pay any interest on the money it raises. However, the corporation loses control over stockholders.

Debt Financing:

Debt financing means borrowing money from lenders. They may include banks or bondholders. In return, you will gradually repay the loan with interest. Moreover, the company keeps ownership and control with debt financing. This is a major plus. However, the company needs to pay interest on loans regularly.

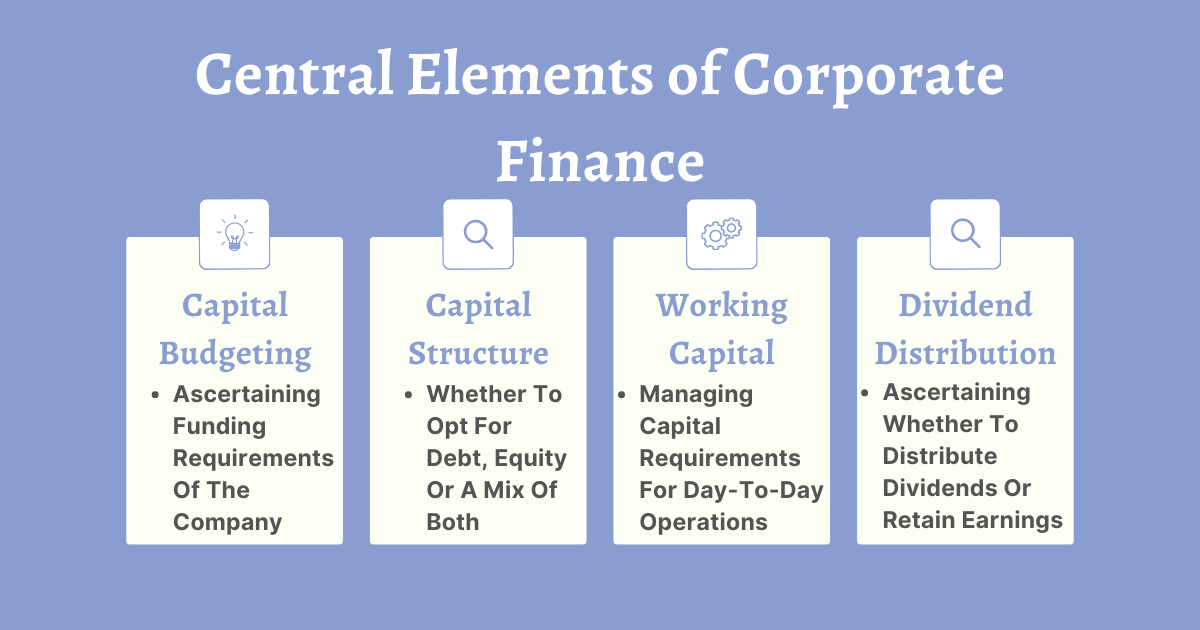

Central Elements of Corporate Finance:

There are four central elements of Corporate Finance. These include:

Capital Budgeting:

Capital planning helps businesses put their money where it will do the best. The goal is to increase sales and earnings as much as possible. So, financial analysts look at the choices for investments for capital budgeting.

Also, they look at both the present and future value of investments. This is how they figure out the risks and benefits of company goals. But only the best ideas are chosen to move forward.

Capital Structure:

The organization’s financial plan can be seen in its capital structure. It is made up of loans, retained earnings, and property.

Furthermore, investors don’t like too much debt or too much stock. They want to have the right balance of loans and equity. So, the right financial choice gives you the most ways to get money. This makes the market value of the company go up.

Working Capital:

Working capital covers the costs of running a business daily. Financial management helps make sure that a business’s cash flow is smooth. Also, keeping the organization’s cash flow in good shape can keep it from going bankrupt.

Dividend Distribution:

The dividend strategy of a company is part of corporate finance. It is the amount of money that partners get from the business. They get them in the form of dividends. However, this requires analyzing the company’s cash flow and business.

Undistributed revenue can also help a company grow. This is a simple and great way to get money. By giving out more shares, it doesn’t add to its debt or dilute its ownership.

Examples:

Here are some popular examples of corporate finance:

Initial public offering (IPO):

When a company makes its stock public, this is called an IPO. It helps raise money through a method of equity financing. Additionally, the company’s shares can be sold and bought at market price. Then the public can buy and sell it on a stock exchange.

Bank Loans:

A company can borrow money from the bank. They do this to cover their expenses. This is referred to as debt capital. However, they must consider the amount of the loan and its return time. Moreover, bank loans are good debt, but too much is not. It can bankrupt a company.

Mergers and Acquisitions:

Mergers and acquisitions play a major role in the growth of companies. This involves buying or merging a business. This is done to make it successful. Therefore, this will always result in higher earnings. But, it should be done properly.

What Is Corporate Finance Advisory?

Corporate finance advisory is a service that helps companies to handle their funds. Financial experts help their clients with a wide range of problems. They include mergers and acquisitions, capital structure, and stock and debt financing. Corporate experts also handle cash management, risk management, and planning.

The purpose is to help customers make good financial decisions. So the business can make better financial choices. Moreover, corporate finance advisers work closely with management teams. They find ways to make things better. They also make economic models to aid in making decisions. In this way, they help companies handle their money better.

What Is Wacc In Corporate Finance?

WACC stands for the weighted average cost of capital. It’s a tool for determining how much capital a company needs. Additionally, a company’s WACC is its average asset financing rate. You can derive it by averaging the company’s capital sources’ rates, weighted by their proportion.

Moreover, a greater WACC denotes a greater cost of capital. It could make some projects look less appealing. However, a lower WACC suggests a lower cost of capital. This increases the possibility of more projects.

You can use this formula to find the organization’s WACC:

WACC: (E/V X Re)+(D/V X Rd X (1-Tc))

The final figure will show the company’s cost per dollar of capital increased. It can serve as a discount rate when making investment decisions.