What is Capital:

Capital is a broad term. It refers to cash or liquid assets that people use to make expenditures, or, in other words, money used to make more money. This is linked to cash that serves investment purposes. Without it, not a single activity takes place. Moreover, companies have needs in the production process of their goods and services. They invest in all types of business activities to increase their revenues.

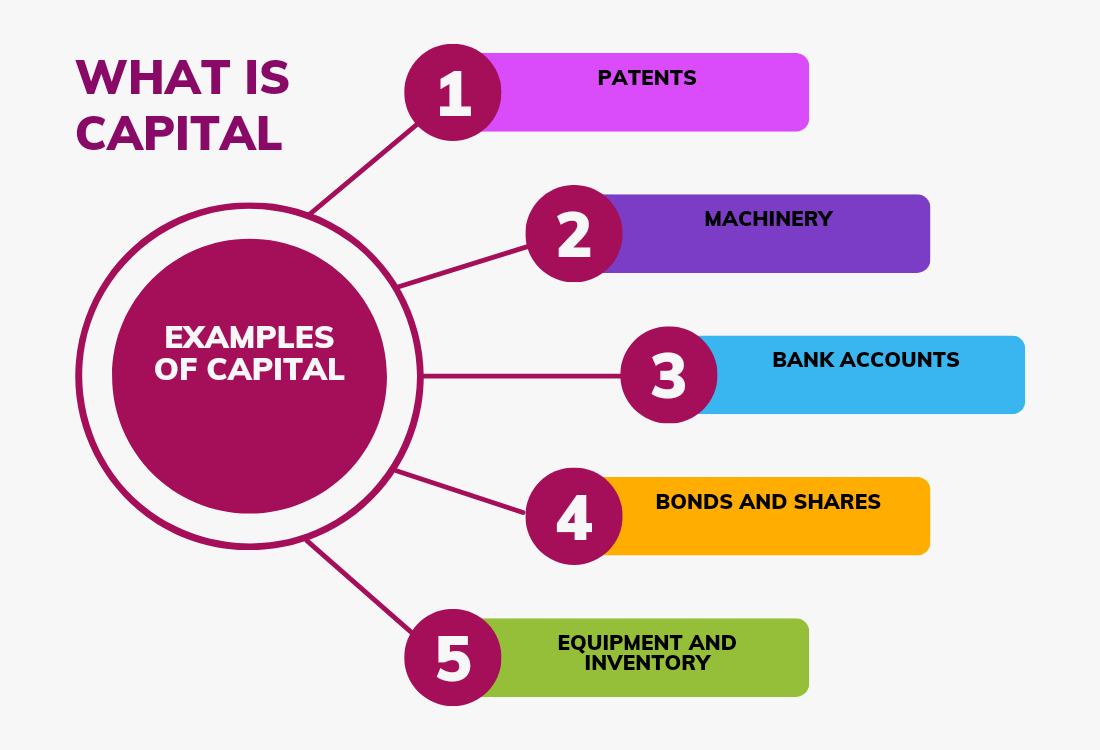

Examples of Capital:

There are some illustrations:

- Company carsPatents

- Machinery

- Inventory

- Bank accounts

- Bonds

- Shares

Importance of Capital:

Companies, businesses, and corporations have funds that they invest in the production of goods and services.

- Capital plays an important role in society. Without it, the process of production does not occur. To meet the needs of modern society new equipment and methods are used in production.

- Capital plays an important role in the development and improvement of the economy. In spite of capital, the government is not able to provide facilities to the citizens of their nation. As the population increases, day by day, It is becoming necessary to fulfill the needs of society.

Capital in Finance

It refers to cash or liquid assets that are obtained for expenditures. Financial capital is a major resource of money that is used, by entrepreneurs, corporations, and businesses. So, This capital is used to invest in the activities necessary to produce their products. The capital is also used to provide services.

Capital in Business

The finances of a business are used to run the daily activities of the company. It provides funds that help in the purchase of assets. The assets include machines, equipment, inventory, etc. It is funding for both short-term and long-term processes in the business.

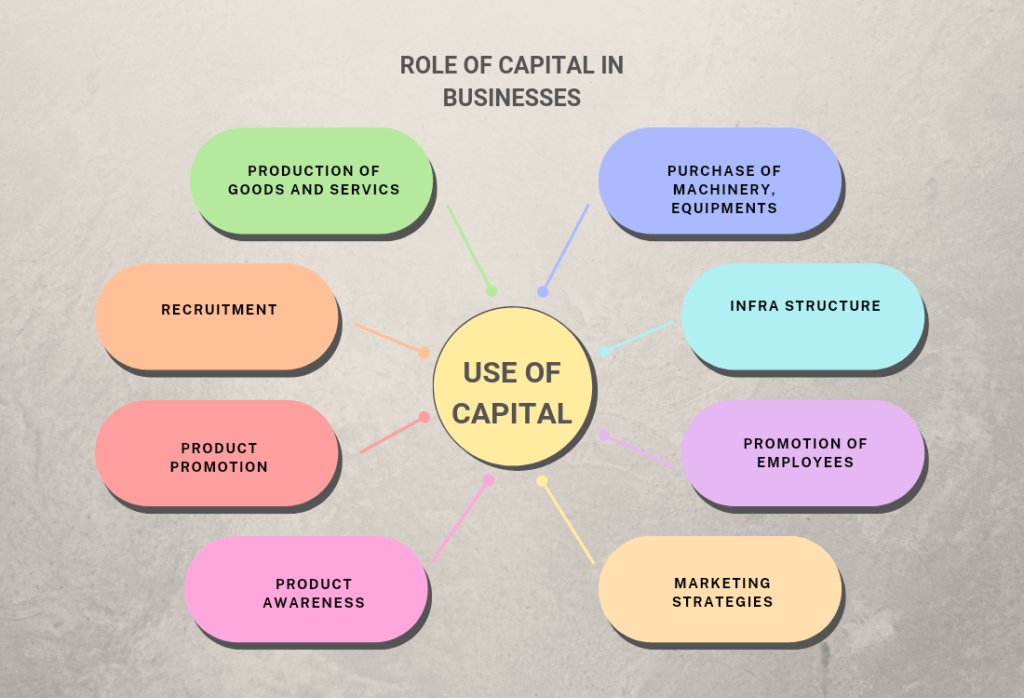

Use of Capital

Capital plays an important role in the utilization of any activity. Governments, corporations, businesses, and individuals all need capital to survive in the world. For this purpose, Companies invest resources in their operations to create value. At the national level, governments make sure that their investments generate revenue for the nation.

Capital is used by businesses in the following ways:

● Production of Goods and Services

Companies use capital to produce goods and services for customers. They spend or invest large amounts of capital to achieve their desired results.

● Purchase of Machinery and Equipment

Furthermore, with the help of financial resources, companies can buy new machinery, inventory, and materials that are necessary for the production of their goods and services.

● Product Awareness

Businesses use funds to promote their products and services. They invest money in advertisements. Businesses give product awareness to society with the help of advertisements.

● Marketing Strategies

Businesses use different marketing strategies to promote their products and services. They spend a lot of money on marketing their products. They know that customer knowledge related to products and services will increase their revenue.

● Infrastructure

Proper infrastructure is important not only for business but also for the economy of the country. Businesses invest a large number of funds to maintain and enhance their infrastructures.

● Recruitment of Employees

Financial resources allow businesses and corporations to hire more people. Businesses invest financial resources in hiring new employees. Likewise, By increasing job opportunities, the employment rate is increasing. Increasing the employment rate increases the production of goods and services. Businesses invest their funds in the purchase of several assets for carrying out their operations. Some assets are:

● Financial Assets

Businesses invest their funds in financial assets. Financial assets are those assets that can be liquified. Financial assets are cash, bonds, and securities.

● Tangible Assets

Businesses use their financial resources to purchase tangible assets for their daily operations. Tangible assets are those assets that are used in the production process, such as machines, equipment, and inventory. These are used to make a product.

● Intangible Assets

The business invests its finances to purchase intangible assets. Intangible assets are those assets of the business that are not physical. But still, they create value for the business. It includes patents, trademarks, brand equity, etc.

Capital Assets:

The best description of these assets is that they are defined as the property of a company. It may be machinery, land, patents, trademarks, etc. In companies, it is defined as the assets that are used in business operations to generate income for more than one year.

It has two kinds

- Short-term capital assets

- Long-term capital assets

Short-Term Capital Assets:

Short-term capital assets are those assets that are held for a period lesser than the prescribed holding period.

Long-Term Capital Assets:

Long-term capital assets are those assets that are held for a duration longer than the prescribed holding period.

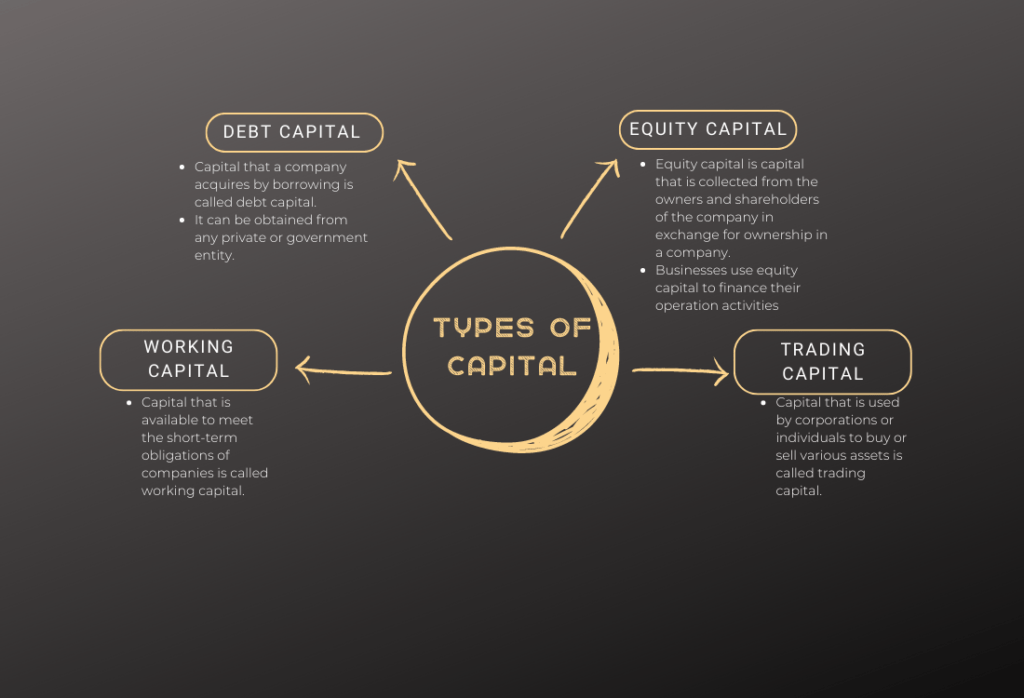

Types of Capital:

It has four types:

- Debt capital

- Equity capital

- Working capital

- Trading capital

1. Debt Capital

The Finance that a company acquires by borrowing is called debt capital. In the same way, companies arrange their finance by taking out loans. Although, it can be obtained from any private or government entity. This Debt must be repaid on a regular basis with interest. Even though, the rate of interest depends on the amount of finance and the history of the borrower. This borrowed money is used to purchase assets for companies and is also funded for operational activities to generate profits for the companies and corporations.

However, it may be for the long-term or the short-term. Corporations that are highly established can borrow money from banks and financial institutions. Corporations issue bonds to raise their debt finance, mostly when the interest rate is low, making it cheaper to borrow. Moreover, businesses consider debt finance a great opportunity for running their operations. Businesses and their investors always keep an eye on the debt-to-capital ratio.

2. Equity Capital

Equity capital refers to the finance that is collected from the owners and shareholders of the company in exchange for ownership in a company. Businesses use equity Finance to finance their operations. Furthermore, it is beneficial for corporations because it generates a huge amount of finance that can be used in various operations. Besides all this, it is used for long-term projects.

It has two types

- Public Equity

- Private Equity

● Public Equity

Public equity refers to shares and ownership in a company. However, these are bought or sold through a public market. For this purpose, a company should be listed on a public stock exchange. When a company goes public, it allows investors to become part of its business. Consequently, some investors become owners of or have shares in their companies. Public equity is safer than private equity. For this purpose, investors use public equity for investment. Public equity is available to all and can be liquidated.

● Private Equity

Private Equity is raised by a group of investors. Consequently, only investors are allowed to invest. However, they are not listed on the public stock exchange. Although, private companies offer investments that are limited to stocks. Moreover, private equity firms can raise finance from investors by charging them achievement and management fees.

3. Working Capital

Funds that is available to meet the short-term obligations of companies is called working capital.

In simple words, it is defined as It covers the overall short-term expenses of the company. It is also defined as the difference between the current assets and current liabilities of the company. Similarly, some companies use working financial resources to facilitate their day-to-day operations, pay their short-term debts, and purchase inventory, which is important to carry out their activities. For instance, it affects many activities in businesses. The activities may include the pay of employees and planning to achieve the desired goals. The working capital can be calculated as

Working capital = current assets – current liabilities

4. Trading Capital

When corporations or individuals buy or sell various assets, this is called trading capital. Brokerages and financial institutions use this term because they do a large number of trades daily.

Capital Gain and Capital Losses

Here we will be able to learn about capital gains and losses.

● Capital Gain

The business invests its funds in operational activities to generate revenues for the company. When investment increases the company’s growth, it will increase financial resources. When an investment in your business has more worth than its purchase price, it is called a capital gain.

● Capital Losses

Businesses invest in different activities to generate earnings, but not every investment results in revenue in the end. When an investment in your business has less worth than its purchase price, it is called a capital loss.

Capital Markets

Markets, where funds are raised, are called capital markets. In simple words, buyers and sellers raise their money. The funds may be in the form of financial instruments. However, the financial instruments are bonds, securities, shares, etc. financial markets are a broad term where suppliers are investors and banks and those who raise funds are businesses, corporations, and governments. Capital markets help people utilize their resources and ideas in a useful way to become entrepreneurs. With the help of financial markets, small businesses prosper and grow into big companies.

There are two types of markets:

- Primary market

- Secondary market

● Primary Market

Primary markets are markets where companies sell financial instruments for the first time. However, this is the market for new shares. Governments, corporations, and businesses raise their funds by selling their financial instruments in this market.

● Secondary Market

In secondary markets, buyers and sellers raise their finances with the help of trading previously issued financial instruments. However, issuing companies have no role in secondary markets.