What is Auditing

An assessment and evaluation of the financial statements of a company are called auditing. it is performed by a third party. In auditing, they evaluate a person, company, strategy, methods, enterprise, project, or product. In short, it can apply to all parts of the company or specific portions. It is a process of reviewing and substantiating financial statements.

Importance of Auditing

It is a vital term that is used in finance and accounting. This term is used to examine and verify the financial records of the company. However, to make sure that all data is accurate and credible. In this process, audits are conducted to make sure that all the data in financial statements are related to accounting standards. The financial statements consist of

- Income Statement: The income statement of any company consists of revenue, net income, and expenses. It indicates the income and expenditures of the company. Similarly, it shows the loss and profit of the company over the year. In short, it shows the execution of the company over the period.

- Balance Sheet: A complete report of assets, liabilities, and owner’s wealth of the company is called a balance sheet. Moreover, It is the overview and detailed documents of the financial balance of an individual or organization. The organization may be a partnership, corporation, sole proprietorship, etc.

- Cash Flow Statement: A financial statement that gives aggregate data related to cash inflows and outflows that a company receives from its operations, activities, and investment resources is called a cash flow statement.

Management is responsible for making these financial statements. Moreover, they use different standards of accounting like Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Likewise, these financial statements are prepared to facilitate the shareholders, customers, partners, suppliers, government entities, etc.

Financial Statements include all transactions of the company including operations, investing, and financing activities. Mostly the preparers of financial statements make their company more successful than actually by preparing inaccurate statements. So, auditing plays a vital role in making sure that businesses or companies represent accurate financial statements according to accounting standards.

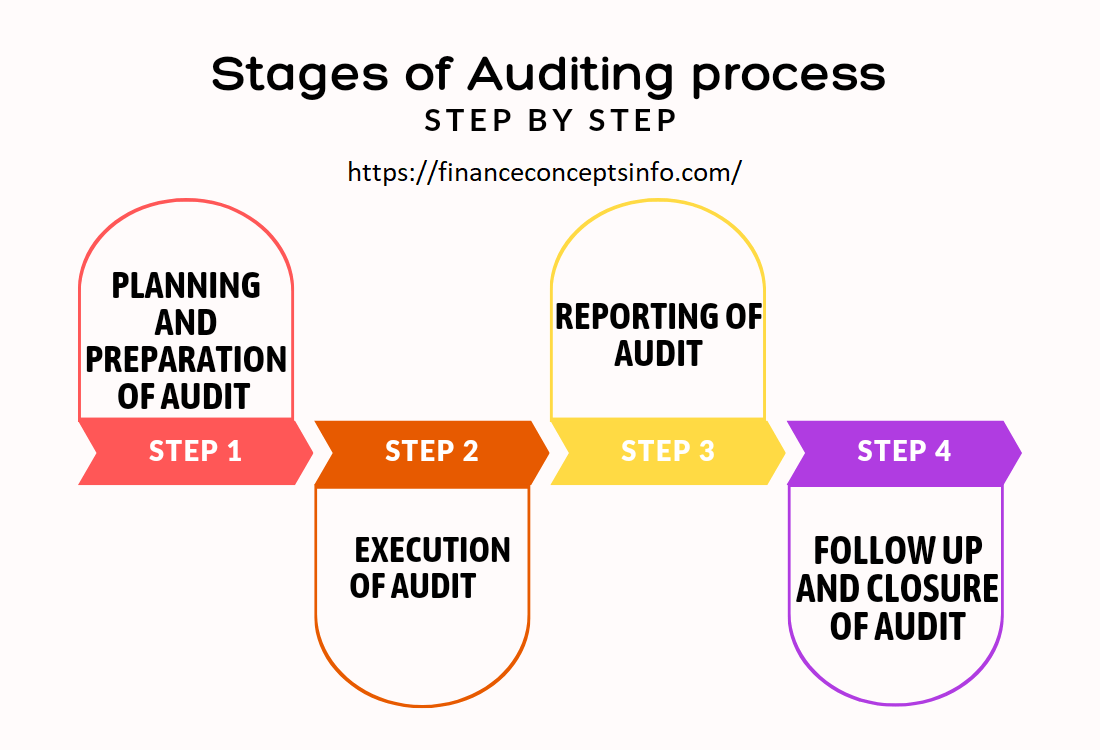

Stages of the Auditing Cycle

There are four phases of the audit cycle:

- Planning and preparation of audit

- Execution of audit

- Reporting of audit

- Follow-up and closure of audit

1. Planning and Preparation of Audit

First of all, auditors have to plan everything before starting the process to make sure that the audit compiles with the objective of the client or company. Auditors plan every step to begin their audit process. So, all decisions are made that are necessary to start the process. Likewise, audit objectives are defined and methodology or method must be designed to carry out the whole process in a smooth way. At the end of this phase or stage, the audit process starts.

- Notification Letter: Sometimes, the client of the audit is informed in writing about the area selected for the audit. Mostly, the letter is sent to executive officers of companies whose areas are going to be audited. They provide a group of questionnaires or lists to the auditors or audit team that help them to understand the functions or units.

- Entrance Meeting: An entrance meeting is planned with the heads of departments or units that are part of the audit. The meeting depends on the audit type and quantity of audit work. In addition to this meeting, objectives must be discussed, explained the methodology of the audit, estimation of time and resources, and any query related to the audit must be answered.

2. Execution of Audit:

The execution stage is also known as fieldwork. It is a data-gathering stage and covers the time duration from starting to the exit meeting. It consists of numerous activities such as understanding process and system controls, verifying and testing resources, and building a good communication channel among members and auditees. Mostly the audit teams conduct interviews with employees to examine the records that are necessary for the audit. However, the period of the audit depends upon its size and scope. Audit of a limited size and scope may be completed in a week or two. While broad audits may be completed in many months. Further, auditors or audit teams continuously informed their clients through communication. They discuss every observation and make necessary recommendations.

3. Reporting of Audit:

A report is a written document that includes all the final results of the audit. Every detail is written in it. It includes scope, objectives, or purposes, any recommendations that are necessary to make improvements, and at the end, it includes responses of the clients of audit and action plans for corrections.

- Draft Report: First, the draft report is prepared by the audit team. This draft report is distributed to managers of the area so they can review the report. Make recommendations if necessary. If recommendations are made then audit clients are requested to answer the questions. Similarly, the questions are about a corrective action plan that resolves the problem, the root cause of the problem, the person who will implement the plan, and the date of implementation of the plan. In short, all the points are included in the final report.

- Exit Meeting: Exit meetings provide opportunities for the client of the audit to ask any question related to the results of the audit. These meetings are held to resolve problems before the preparation of the final report.

- Final Report: In the end, after making changes, the final report is prepared and submitted to the executive officers of the company.

4. Follow-up and Closure of Audit:

Sometimes, after the final report, the audit issues are still not resolved by using corrective actions. In these cases, a follow-up process is used to resolve the issues or problems. In this, the audit team reviews all processes. Furthermore, they determine whether the corrective action plan has been implemented effectively or not. When, they conduct interviews with staff and review their implementation process. Additionally, they review every step and make corrective actions where needed till they achieve their desired results. However, after getting the desired result the audit team closes the audit process.

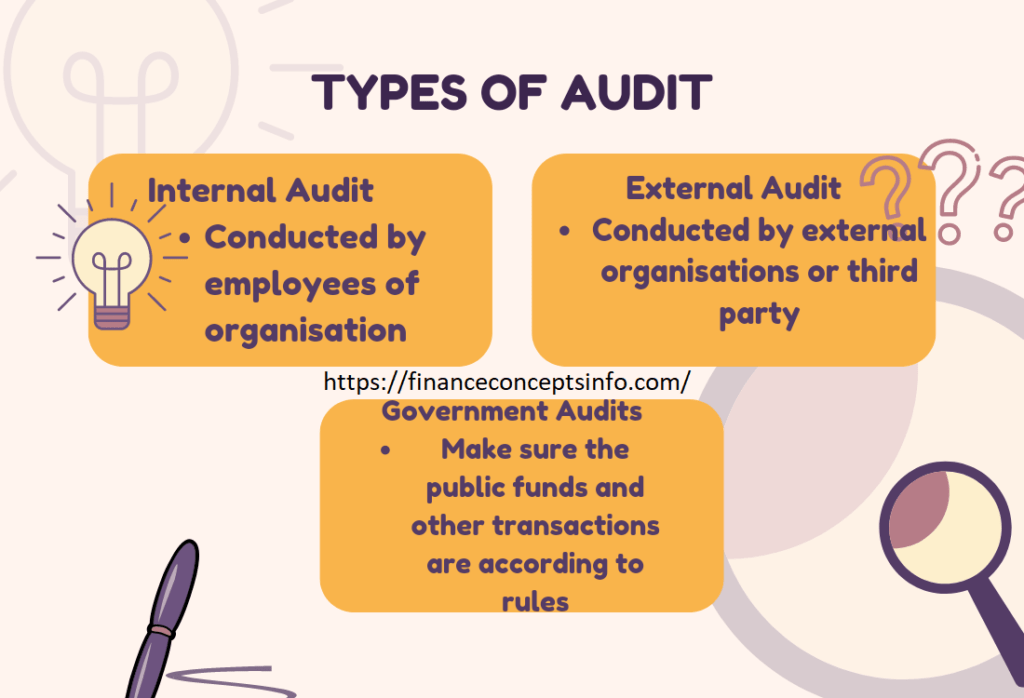

Types of Auditing:

There are three types of audit

- Internal audits

- External audits

- Government audits

1. Internal Audits

An internal audit is an audit that is conducted by auditors of the company. It is prepared to check how efficiently the company can manage its operations and processes by maintaining standards and regulations. However, Companies conduct an internal audit on time to check the efficiency of their work. Employees of the organization work as internal auditors. Results of internal audits are used by the management to improve their working areas. Companies use the results of internal audits in their decision-making process. They make accurate and fair reports. They provide managers with corrective actions so they resolve the problems. Internal audit helps managers to review their financing statements. These reports are not distributed outside the company.

2. External Audits

External audits are those audits that are conducted by external organizations or third parties. These audits are conducted by an audit team that is not part of the company. It works under a defined set of rules and standards. It verifies that the provided financial statements are accurate and acceptable. In an external audit, the main goal is to provide confirmation or proof to all investors that the financial statements of a company are prepared fairly. The audit team or auditors make a complete plan to conduct the whole process. When the auditors have completed their work they make the report and submit it to the executive officers. The executive officers use the results and take corrective action where needed.

3. Government audits

Government audits are conducted to make sure that the financial statements of the company are accurate and fair. They make a complete report that represents that the company’s taxable income is accurate. The main objective of the government audit is to make sure the public funds and other transaction activities are in line with the rules and regulations of the state. The internal revenue services (IRS) performs an audit that ensures that taxable payment of companies is valid. In the end, hand over the report to the executive officers of the company.