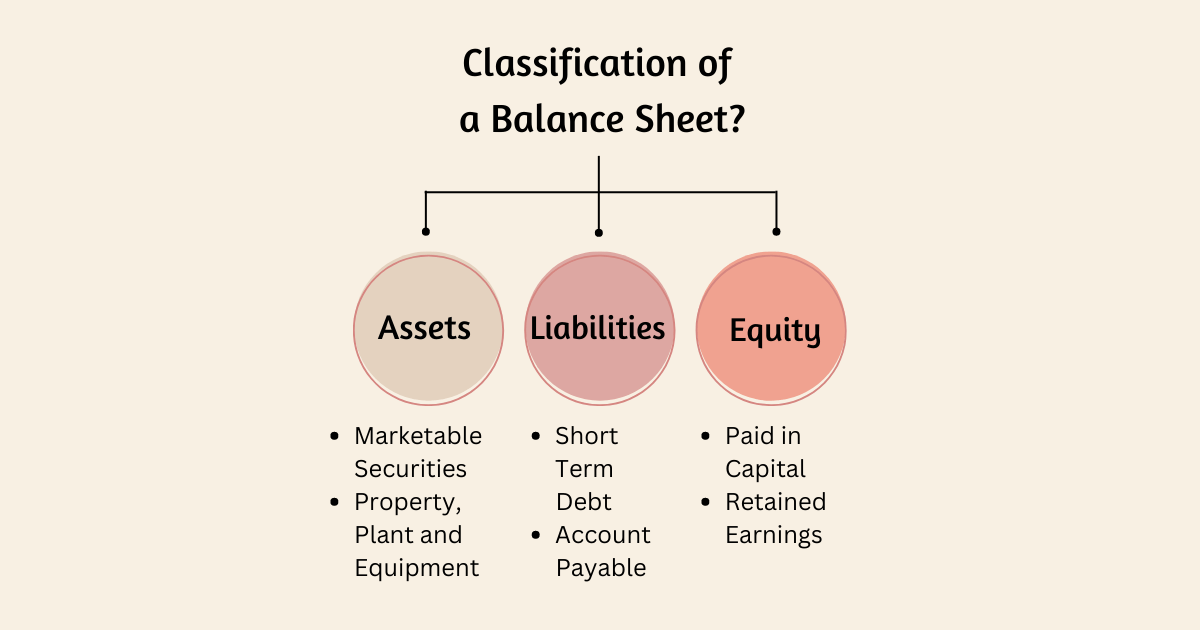

A balance sheet is one of the major financial statements of a company. It shows the assets, liabilities, and equity of a company at the closing date.

The assets of a company provide future economic benefits through which income can be generated. Examples include cash in hand or bank, inventory, accounts receivables, or fixed assets like property, plant, and equipment.

Liabilities of a company are those obligations that the company needs to fulfill, this is usually in the form of outflow. Examples include tax payable, accounts payable, or bank loans.

In addition, equity will show the retained earnings of the company that it has after deducting all its liabilities.

The company can either be a sole ownership, a partnership, or a private limited company. Therefore, a balance sheet is an essential element in determining a company’s year-end balance.

Moreover, a classified balance sheet helps to make the balance more user or reader-friendly.

What is a Classified Balance Sheet?

A classified balance is a more readable version of a balance sheet. It is basically a breakdown of all types of assets, liabilities, and equities that go into creating the year-end statement. It has two sides, one containing all the information on assets and the other side focusing on the liabilities and shareholder capital or equity.

A typical classified balance sheet would look something like this –

Classified Balance Sheet

Assets $

Non-Current Assets

Property, Plant&Equipment

Goodwill

Current Assets

Inventory

Cash in hand

Accounts receivables

Prepaid expenses

Liabilities $

Non-Current Liabilities

Long term lease

Deferred tax

Current Liabilities

Short term debt

Bank Overdraft

Accounts payables

Accrued expenses

Interest Payable

Equity

Retained Earnings

Total Assets Total Liabilities, and Equity

Classification of Assets on a Balance Sheet:

You can divide the assets on a typical balance sheet into two categories-

- Non-Current Assets

- Current Assets

Non-Current Assets:

Non-current assets on a balance sheet represent the assets that have a long-term value, usually lasting more than a year. These are further sub-categorized into tangible and non-tangible assets.

Tangible assets are those non-current assets that have a physical form and will last the company throughout its years. These are also referred to as fixed assets.

Some examples include land, machinery, property, plant, and equipment. Furthermore, these items usually have a book value and must be depreciated over their useful life.

This sheet will include the post-deprecation amount of these assets, i.e., cost-depreciation to reach book value.

Non-tangible assets, on the other hand, are those without a physical form. These do not have a monetary value but add value to the business otherwise. Examples include goodwill, trademarks, copyrights, etc.

Current Assets:

These are usually short-term assets, and you will use them only in the current financial year. You can easily convert them into cash and use them immediately.

For example, a company may readily have cash in hand to use by means of petty cash and use them to pay off their debtors. Moreover, you can also sell inventory to meet the payments. Similarly, any outstanding payments due to the company can be made through incoming accounts receivables.

Hence, non-current and current assets together add up to one side of the balance sheet. They should be equal to the opposite side of the liabilities and equity.

Classification of Liabilities on a Balance Sheet:

You can divide the liabilities on a balance sheet into two categories-

- Non-current liabilities

- Current liabilities

Non-Current Liabilities:

Non-current liabilities are those obligations of a company that do not require to be settled within the year. Moreover, these are usually long term lasting 4-5 years.

Some examples include- long-term debt, deferred tax, and lease payments.

Current Liabilities:

Current liabilities, on the other hand, are obligations that need to settle within the financial year. For example, a short-term debt that needs to be paid off or accounts payables.

Equity:

The equity of a balance sheet is the most important figure. This is because it will show the financial value of the company. Furthermore, it will depict whether the company will grow further.

Additionally, this figure shows how much capital is being invested in the company or how much of the earnings were retained from the previous year.

Some examples of equity include retained earnings, accumulated income, and shareholder stocks.

In summary, the classified balance sheet provides a complete picture of the company’s financial health at a particular point in time and will help make users informed decisions.