What is Income?

Income is the money that a person or company gets in return for their services. It is usually in the form of cash. There are various types of income. The type of income a person is earning depends upon the situation. You could think of your paycheck as your primary source of money.

People usually earn income through salaries and wages. But other types of income may include pensions, inheritance, or gifts. On the other hand, businesses make money by selling their products or services. They get a profit by selling services above their original production cost.

What are the Different Types of Income?

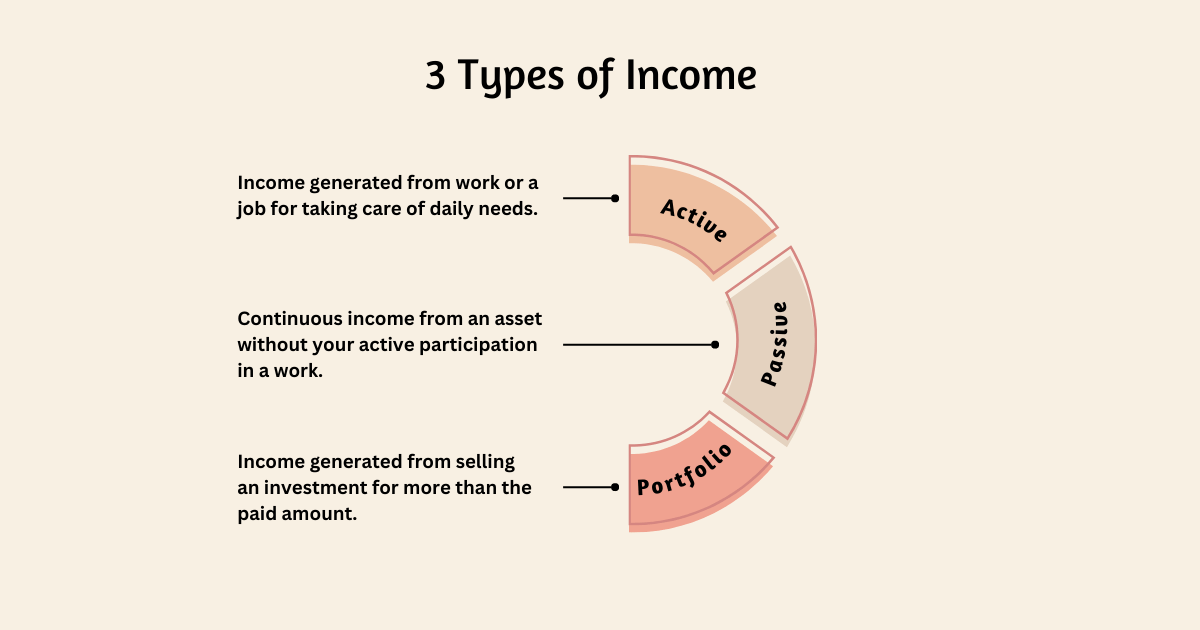

There are a number of methods to earn or get income. Sometimes, you have to actively take part in work to get money. But, sometimes, you can get it as a benefit, gift, or inheritance. Let’s have a detailed look at the different types of income:

Active Income:

Active income is the most common way people make money. You must actively take part in a job to earn this income. It needs your time and effort. It’s the money you make by working. Work for yourself, another person, or a company you own. You actively provide a service for it, so it is called “active income.”

When you offer your services to a company, your employer will pay you. They will pay you on an hourly basis for the time that you put in. They may also pay you a salary. It is a specific amount of money to complete a particular task. You can get your salary weekly, fortnightly, or once a month. Bonuses and overtime pay are also possible sources of active income.

Examples:

Suppose you work as a cashier at a store. The money you will make there will be active income. It is because you will work there at specific hours to complete a certain task.

Other types of active income include laborers, taxi drivers, freelance writers, food delivery riders, babysitters, etc.

Passive Income:

It is the type of income generated by any resources you own. You don’t have to take part in any work actively. It is a type of income in which you can earn even by sleep. That’s why it’s called “passive income” or “unearned income.”

You will have more control over it than with active income and investments. Moreover, you get your profit on a periodic basis, just like active income. However, the amount of money will not depend on the number of work hours. Instead, it depends on the amount of money you invest in it. These types of income also have lower taxes than active income.

Examples:

Suppose you lend some money to a friend to open a restaurant. In return, he will give you a certain amount of share from the profit. This is a passive source of income. It is because you do not have to do much to earn money.

Other types of passive income may include alimony, limited partnerships, royalties, home rentals, etc.

Portfolio Income:

This is the type of income you get from selling your old investments. When you sell an investment, the price is significantly higher than its previous price. A financial portfolio is everything you own that has monetary value. Portfolio income includes interest, dividends, and capital gains.

This income has nothing to do with the number of work hours. Furthermore, you do not get profit on a periodic basis. It accumulates over time; the investor pays it when he wants to. Tax rates are also very low compared to other types of income. This only applies to long-term investments.

Examples:

Suppose you invest your money in buying some shares in a company. When the company gets any profit, you will get your part. You can get it in the form of money or buy more shares.

Other types of portfolio income include selling real estate and antiques or investing in stocks, bonds, and mutual funds.

What is Income Tax:

Income tax is a type of tax that states charge individuals and industries in their territory. These taxes are used to fund government campaigns and public service programs. The federal government and several local city councils charge their individual taxes.

What are the Types of Income Tax:

Mainly there are three types of income tax. Let’s have a brief look at these types of income tax:

Individual Income Tax:

This type of income tax is also known as personal income tax. This tax is imposed on a person’s earnings, salaries, and other assets. State governments typically impose this tax.

Many personal income taxes are “progressive.” Basically, it means that tax rates go up in tandem with a person’s income. Higher earners have to pay more income taxes because of this. Most people do not pay taxes on their full income due to fear of deductions.

Corporate Income Tax:

Corporate taxes are imposed by federal or state governments on industries. This includes the profits and revenues a business make. Corporate businesses have to pay taxes depending upon their company structure.

All the owners, shareholders, and employees have to pay individual taxes. When companies have to pay taxes, it has a negative effect on their workers. It is because the rates of products go up, but the wages do not.

Capital Gains Tax:

Capital assets are everything owned for personal purposes. These consist of securities like stocks, bonds, property investments, vehicles, jewels, and artworks. When the value of one of these assets goes up, this is called a “capital gain.”

Taxes on capital gains are due when an investor gets a profit in taxable countries. Capital gains taxes effectively double-tax a single dollar of investment income. It’s referred to as double taxation. That’s because taxes on corporate profits are already very high.

Summary:

There are many different types of income that a person can earn. Knowing the different types of income can allow you to make better choices. You can research investment options and make plans for a secure future.

In addition, it is important to know the tax rates and timing of different income streams. So you can see the whole picture and act accordingly. Hence, knowing about different types of income helps you manage your finances and earn more.