The profit maximization formula is about making the most money for a business. It involves finding the best way to produce goods or services while keeping costs low. The goal is to find the ideal balance between production and cost to maximize profits.

Imagine you have a lemonade stand. And you want to sell as many cups of lemonade as possible. All the while spending as little money as possible on lemons and sugar. That’s profit maximization!

To figure out the best price to sell your lemonade, you need to use a formula. For this, you must consider how much you spent on ingredients or how much you want to make in profit. And how many cups of lemonade do you think you can sell? By using this formula, you can set your prices just right to make the most money possible!

For businesses, profit maximization is an important concept. Because it helps them make smart decisions about how much to produce and sell. For example, a clothing store might use profit maximization to figure out how many shirts to produce at a certain price to make the most money. Thus, it’s like a secret weapon that helps them stay competitive and achieve their financial goals!

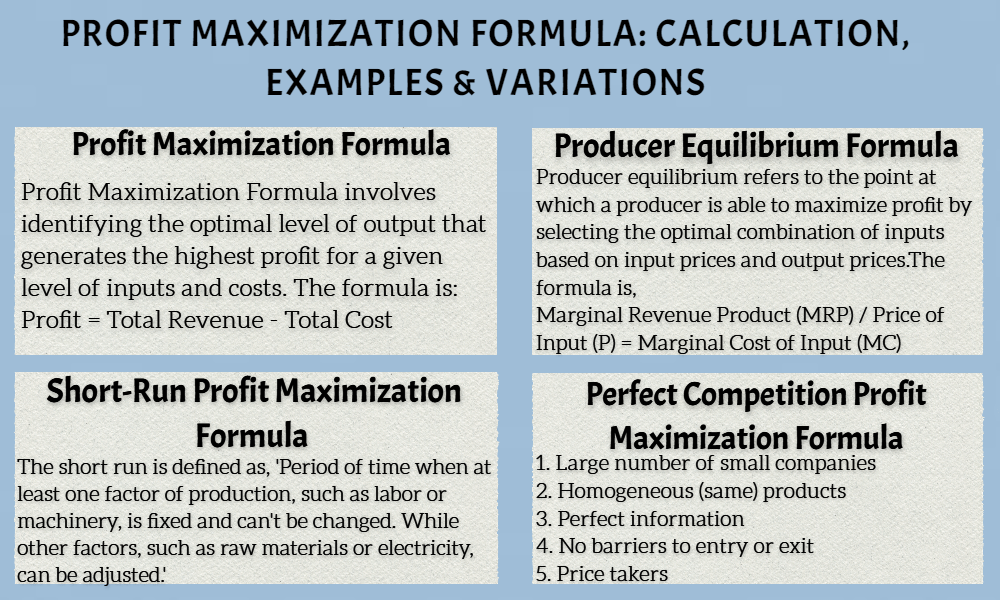

Profit Maximization Formula

The Profit Maximization Formula helps businesses identify the optimal output level to achieve maximum profitability. It considers a specific set of inputs and costs.

The Profit Maximization Formula is:

Profit = Total Revenue – Total Cost

Total Revenue is the total amount of money a business makes by selling its products or services. Total Cost is the total amount of money a business spends to produce those products or services. Profit is the money left over after subtracting Total Cost from Total Revenue.

In simple terms, Profit is what a business earns after paying all the costs of making and selling its products or services.

By carefully analyzing and optimizing the relationship between revenue and cost, businesses can achieve greater efficiency and profitability. Thus, enhancing their overall competitiveness and sustainability.

Short-run and Long-run Profit Maximization:

Short-run profit maximization is the act of finding the best output level only using a specific amount of inputs and costs. This process is carried out during a period when at least one factor of production is fixed and cannot be changed, while other factors can still be adjusted.

Thus, businesses try to make the most money possible in the short term by making the best use of available resources.

Differences between short-run and long-run profit maximization:

The long run is a period of time when businesses have the flexibility to adjust all factors of production to maximize profits. This means they have more control over inputs such as labor, machinery, raw materials, and electricity. On the other hand, the short run is a period of time where at least one factor of production is fixed and cannot be adjusted.

Derivation of the short-run profit maximization formula:

The short-run profit maximization formula is similar to the general profit maximization formula. The difference is that it accounts for fixed costs. Its formula is:

Short-Run Profit (π) = (Price per unit x Quantity of output) – Total Variable Cost (TVC) – Total Fixed Cost (TFC)

Mathematically,

π = (P x Q) – TVC – TFC

Perfect Competition Profit Maximization:

Perfect competition is a type of market where many small companies sell the same product. And there are no obstacles to joining or leaving the market. The firms in this market are not able to control the price of their product and must accept the going rate. This rate is set by the market. To put it simply, they have to take the price offered to them. Because if they set a higher price, customers will go to a competitor that is selling the same product for a lower price.

Example of perfect competition :

In a perfectly competitive market, a business that produces a product costing $2 per unit will keep producing until the point where they can sell each unit for $2.50. This is the market price. This happens because, at this point, the amount of money they earn from selling each unit equals the amount they spent producing it.

However, if the market price falls to $1.75 or less, the business will have to shut down production in the short run. This is because the market price is now lower than the average variable cost of producing each unit. This means that the business is not even earning enough money to cover the variable costs, such as materials and labor. And it would be better to shut down production and avoid further losses.

Producer Equilibrium Formula

Producer equilibrium is the point at which a producer maximizes profits by selecting the optimal combination of inputs based on input and output prices. The formula for producer equilibrium is

MRP/P = MC

where MRP is the marginal revenue product, P is the input price, and MC is the marginal cost of input.

For instance, consider a firm that uses labor as its only variable input. The wage rate for labor is $15 per hour, and the marginal product of labor is 10 units of output per hour. Then the marginal revenue product of labor is $150 per hour (assuming a product price of $15 per unit).

If the marginal cost of labor is $150 per hour, then the firm is in producer equilibrium. Because the marginal revenue product equals the marginal cost. The firm will keep hiring labor until the marginal cost of labor equals the marginal revenue product of labor.

Profit Maximization for Inputs Formula

Profit maximization for inputs refers to the process of selecting the optimal combination of inputs to minimize costs and maximize profits.

The formula for profit maximization for inputs is:

Marginal Revenue Product of Input (MRP) / Price of Input (P) = Marginal Cost of Input (MC)

This formula helps businesses determine the level of inputs they should use to produce a given output.

Example of Profit Maximization For Inputs:

Suppose a bakery uses flour and sugar as its inputs to produce cakes. The price of flour is $5 per bag and the price of sugar is $3 per bag. The bakery sells each cake for $20. Then the marginal revenue product of flour and sugar can be calculated as follows:

- Suppose the marginal product of flour is 20 cakes per bag. Then the marginal revenue product of flour is $400 (20 cakes x $20 per cake).

- Suppose the marginal product of sugar is 10 cakes per bag. Then the marginal revenue product of sugar is $200 (10 cakes x $20 per cake).

To maximize profits, the bakery should use flour and sugar inputs in such a way that their marginal revenue product divided by their prices equals their marginal cost. If the marginal cost of flour and sugar is $200 per bag and $100 per bag respectively, then the optimal combination of inputs is:

- Flour

MRP/P = $400/$5 = $80, MC = $200, so use 2.5 bags of flour (200/80 = 2.5)

- Sugar

MRP/P = $200/$3 = $66.67, MC = $100, so use 1.5 bags of sugar (100/66.67 = 1.5)

Using this input combination, the bakery can produce cakes at the lowest possible cost and maximize profits.

Simplex Tableau Formula for Total Profit :

A simplex tableau is a tool used in linear programming. It helps businesses find the optimal combination of inputs to maximize profits.

To use the simplex tableau for total profit maximization, follow these steps:

- Set up the objective function:

This is the equation used to calculate the total profit. It takes into account the cost of inputs and the revenue generated by selling the outputs.

- Identify the decision variables:

These are the inputs that the business can adjust to maximize profit. For example, if a business produces two products, the decision variables might be the amount of each product produced.

- Write down the constraints:

These are the limitations of the decision variables. For example, the business might have a limited budget for inputs, or there might be a maximum amount of output that can be sold.

- Create the initial simplex tableau:

This is a matrix that shows the coefficients of the decision variables in the objective function and the constraints.

- Use the simplex method to optimize the objective function. Also, find the values of the decision variables that maximize profit.

By using the simplex tableau, businesses can make informed decisions about how to allocate their resources to achieve the highest possible profit.