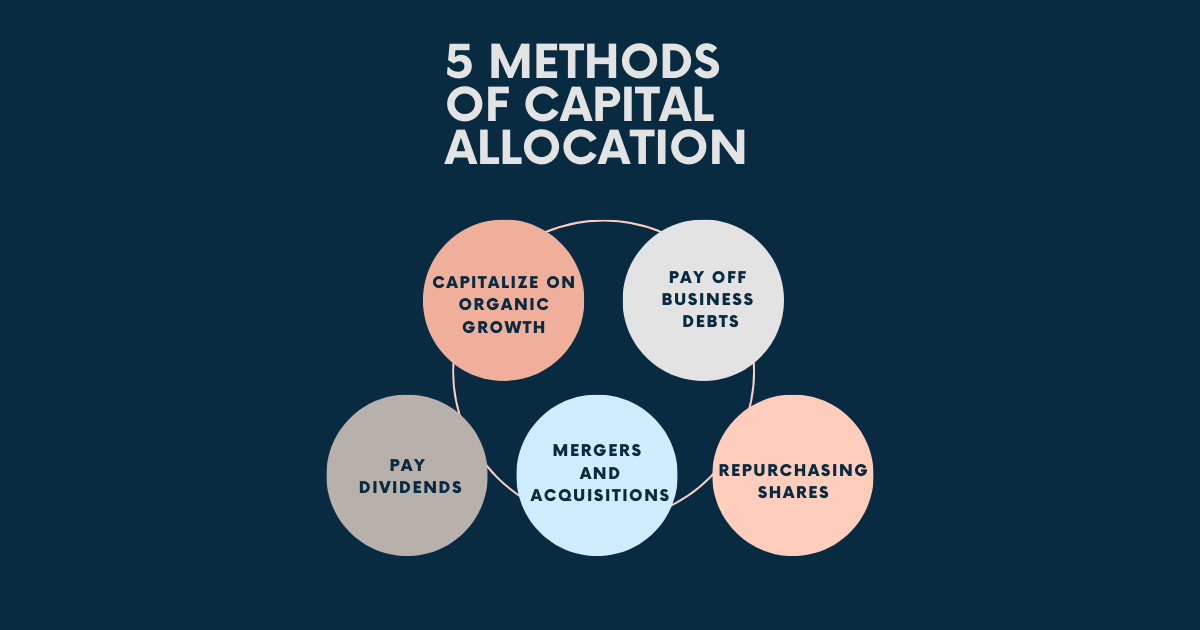

Capital Allocation | Definition, Importance, and Methods

What is Capital Allocation? Capital allocation is a method through which a company chooses to invest its funds. Its primary objective is to increase profits for shareholders. It’s a significant financial decision taken by the CEO and CFO together. They decide how and where the company will invest its profits. Therefore, it’s an essential step for a business’s long-term success. … Read more