In simple non-accounting terms, the liquidity ratio is a financial ratio that helps to determine the assets to pay off the remaining short-term debts. Companies can use current assets to pay off their current liabilities.

For example, a company will use its cash in hand, accounts receivables, and inventory to meet its obligations. It is because these are easy to convert into cash.

In other words, it explains how a company is able to quickly use its cash on hand to pay off its remaining liabilities. For example, the higher the assets of a company, the easier it is for them to pay off its liabilities by using assets as convertible cash.

This ratio is a key factor in determining the financial stability of the company. Just by looking at the ratio, investors can make an informed decision about whether they think the company is stable enough to pay off its debts.

What is a Good Liquidity Ratio?

A ratio of >1 is generally considered to be a good liquidity ratio. This usually depends on industry to industry rather than solely relying on this.

The creditability of the company basically speaks for itself when it has a ratio of higher than 1. Investors will look to invest in your company without worrying about paying off debts on time.

The higher the ratio, for example, 2 or 3, is an indicator that the company is in a safe financial position and will not necessarily face any financial hardships or go bankrupt.

A 2:1 ratio is generally considered safe for a company. It means to pay off every liability, it has double the amount of assets.

How to calculate the Liquidity Ratio?

The liquidity ratio is a financial measure of monitoring a company’s ability to pay off its short-term liabilities. To pay off its current liabilities, the company will use its most liquid or available assets, such as cash in hand or accounts receivables.

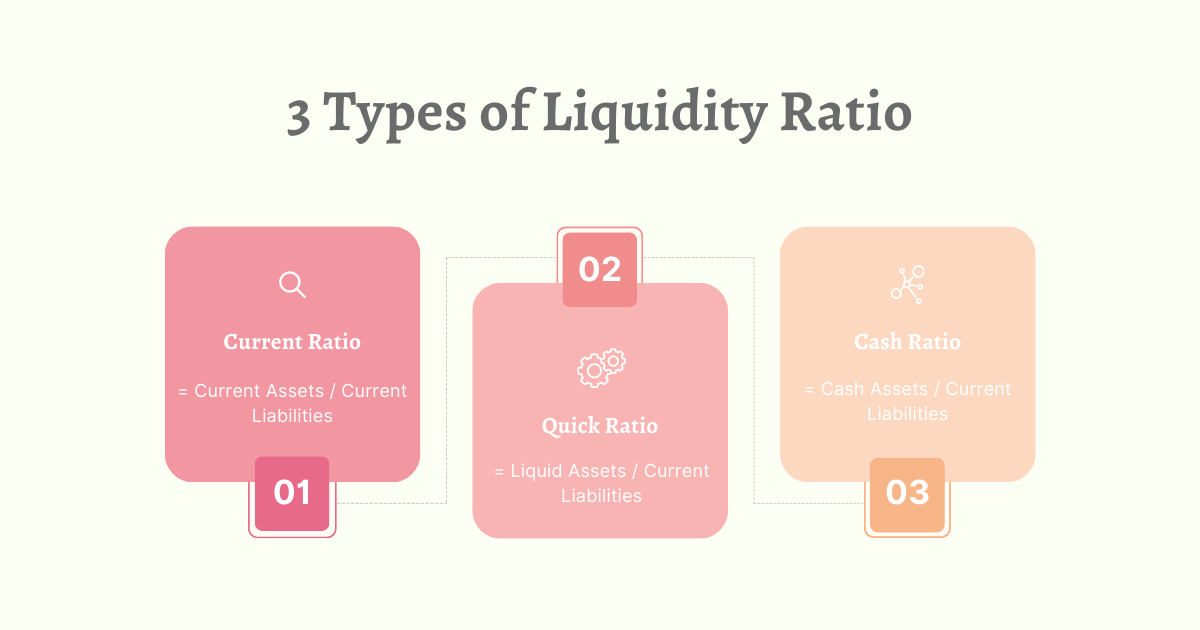

You can use the following formula to calculate the liquidity ratio of a company-

Liquidity Ratio = Current Assets-Inventory/Current Liabilities

This is also known as the Quick Ratio.

How to assess a company’s liquidity?

Financial Ratios to Assess Liquidity:

There are many ways to determine a company’s liquidity position. The most commonly used are financial ratios to assess their performance and to compare the results year to year. This is important because this helps companies figure out how they can meet their short-term obligations.

You can measure a company’s liquidity through its current ratio by adding up all of the company’s current assets and dividing it by its current liabilities. You can easily find these figures on the company’s year-end balance sheet. In simpler words –

Current Ratio = Current Assets/Current Liabilities

The acid test ratio is another method to look at the figure of the quick ratio. A ratio higher than 1 is considered healthy. On the other hand, if it is too like 5 or 6, it may be worrisome and may indicate that the company is not utilizing its cash and is holding debt payments.

A lot of companies will also look at their working capital ratio to analyze the liquidity position of a company. A positive working capital indicates that the company is doing well and has enough assets to pay off its liabilities. Working capital is the difference between the company’s current assets and current liabilities.

Financial Statements to Assess Liquidity:

One can also look at the financial statements of the company to figure out how well it is performing. A positive cash flow figure is a good indicator of the liquidity position of the company.

Similarly, a profit and loss statement showing a positive figure is a good sign for the company.

A look at the company’s debt levels in the statements will also help to know whether the company is stable enough to pay off its short-term obligations. If the debt level is high, it will indicate that the company is struggling.

However, financial analysis or ratios work well only if compared through similar industries but they will generally give you an idea of how well your company is performing.