Financial Management Definition:

The financial management definition includes planning, organizing, directing, and controlling financial activities. Moreover, the financial activities consist of procurement and fund utilization of the company or enterprise. It is a useful and productive way of utilizing financial resources.

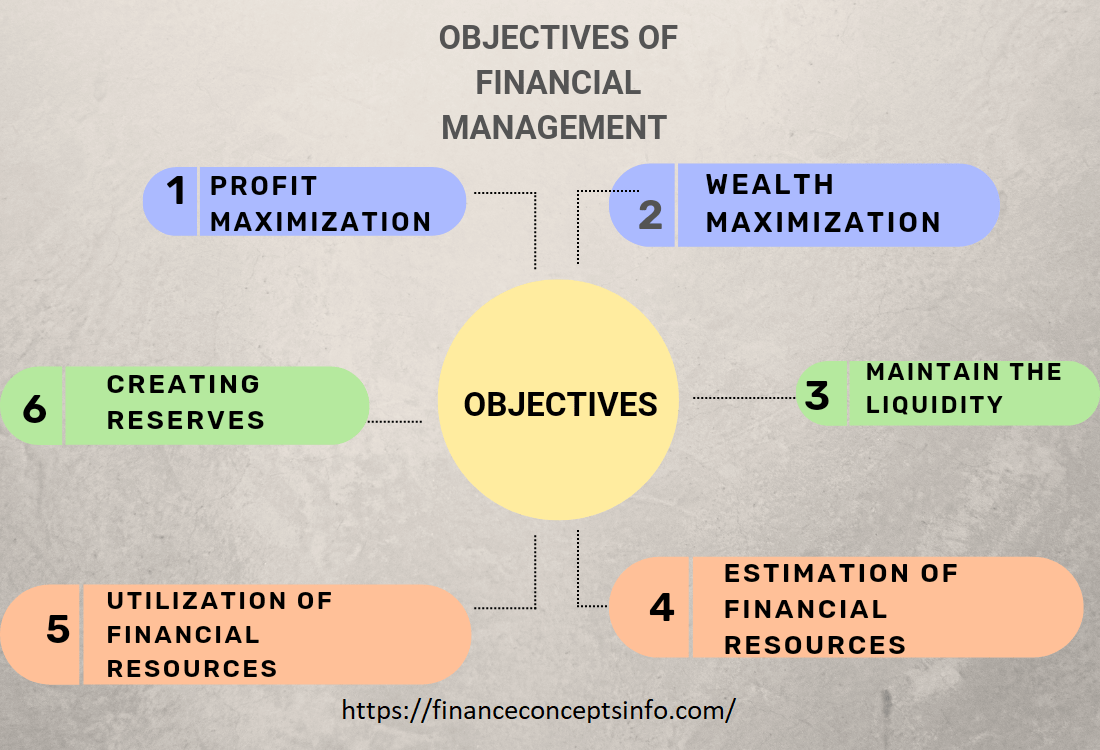

Objectives of Financial Management:

Financial management is an important business function that is associated with some terms. These terms are cash, credit, expenditures, and revenues.

Some of the objectives are:

- Profit maximization

- Wealth maximization

- Maintain the liquidity

- Proper estimation of financial requirements.

- Utilization of financial resources

- Increase efficiency

- Creating reserves

1. Profit Maximization

The most important objective of financial management is profit maximization. However, managers are responsible for creating revenue for the company. It may be for the short-term or long-term. For This Purpose, they use different methods or procedures to create value for the company in terms of profit.

2. Wealth Maximization

The financial manager focuses on the maximization of shareholders’ wealth. For instance, shareholders are owners of the company. It is the responsibility of financial managers to make their shareholders happy by distributing the maximum dividends to them.

3. Maintain Liquidity:

The other objective is to monitor the supply of liquidity. As a result, the managers keep an eye on all inflows and outflows of capital or money to maintain the proper cash flows. The success of any business depends on healthy cash flow.

4. Proper Estimation of Financial Requirements:

Financial managers estimate the financial requirements or needs of the company. It includes the capital needed to start a business, and fixed capital costs. Without financial management, companies may face an excess or shortage of money.

5. Utilization of Financial Resources:

Another important objective of financial management is how properly financial managers use financial resources to achieve the goal of the company or organization. Proper utilization of resources helps to save funds or money for the company and also reduces the wastage of resources.

6. Increase Efficiency:

Here financial managers focus on the increase in efficiency of all levels and departments of the company. Departments of the company work efficiently when finances are distributed effectively among all of them.

7. Creating Reserves:

In business, there is a full chance of uncertainty. It may be a change in customer preferences, a change in climate, a change in technology, etc. Companies or businesses must have money in the form of reserves to overcome such situations. Effective financial management within a company allows for the expansion of business through the use of funds.

Importance of Financial Management:

Financial management is a major business principle that deals with investing the available finances into different operations to achieve a goal.

- It helps in financial planning.

- With the help of financial management, financial managers effectively utilize resources.

- It helps in the allocation of funds.

- Support in critical decision-making related to finance.

- Increase the stability of the economy.

- increase and improve the profitability of the organization.

- It helps in increasing the overall value of the organization.

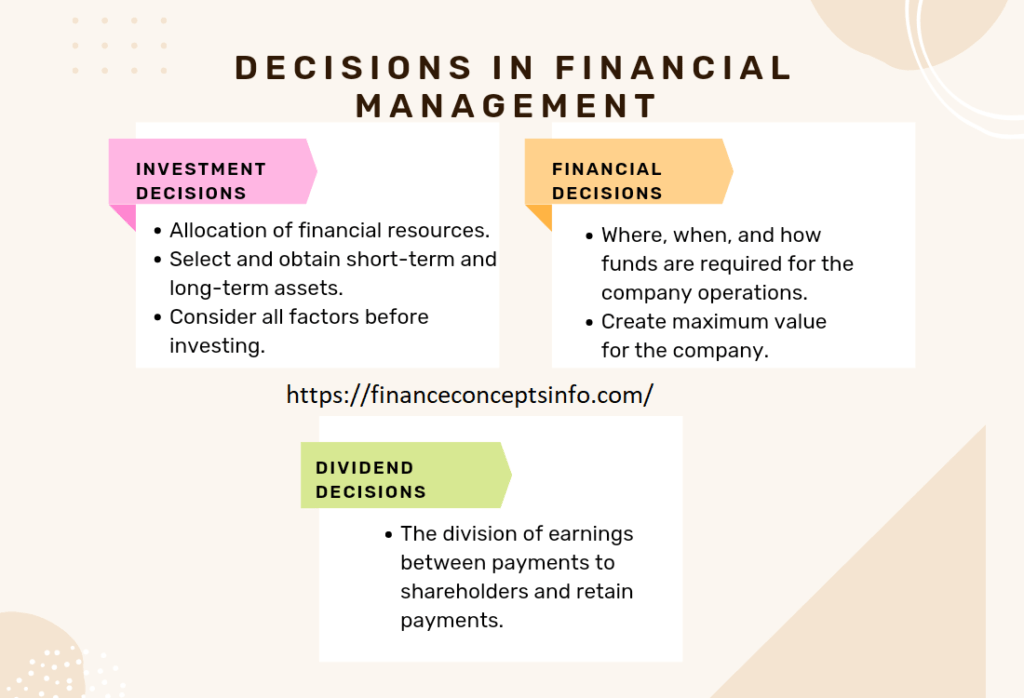

Decisions in Financial Management:

Financial management is the practice of making a business plan and then ensuring that all departments are working according to the plan to achieve the desired results.

It has the following decisions:

1. Investment Decisions:

Investment decisions refer to the allocation of financial resources. Finance managers are responsible to select and obtain the long-term and short-term assets of the company in which funds will be invested are called investment decisions. Financial managers consider all factors before investing.

2. Financial Decisions:

Financial decisions are those decisions that are taken by financial managers regarding when, where, and how funds are required for the operational activities of companies. The goal of his decision is to create maximum value for the company.

3. Dividend Decisions:

The division of earnings between payments to shareholders and retained earnings is called dividend decisions. Financial managers take decisions related to net profit distribution.

The net profits are divided into

- Dividend for shareholders

- Retained profits

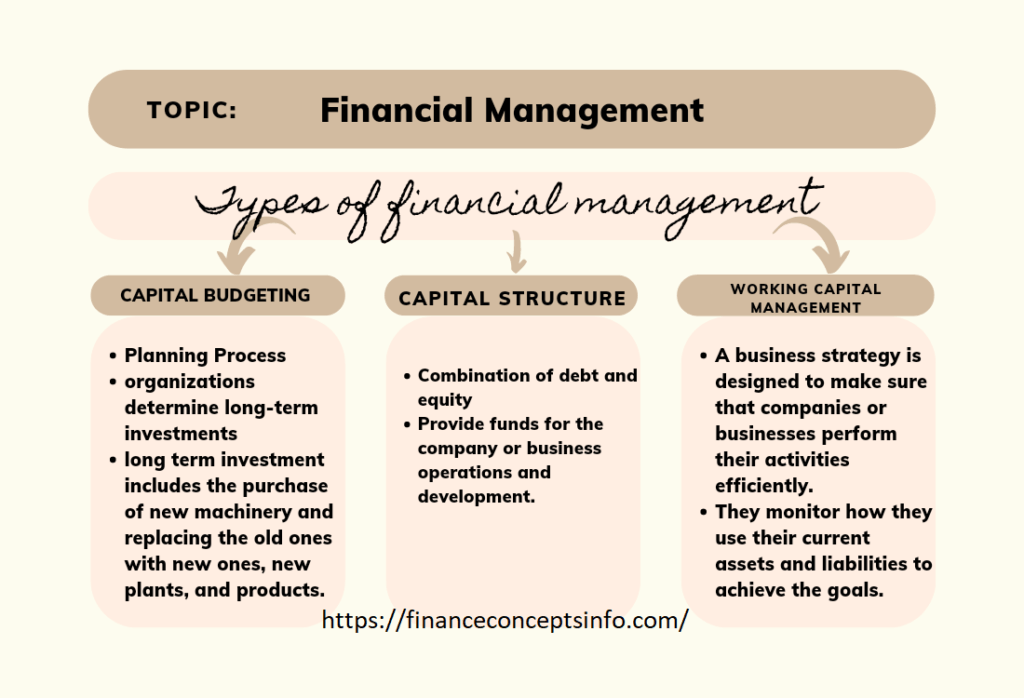

Types of Financial Management:

There are three main types of financial management

- Capital budgeting

- Capital structure

- Working capital management

1. Capital Budgeting:

Capital budgeting is a planning process in which an organization determines that long-term investments are consistent to achieve the goals of the owners to maximize their wealth. Furthermore, the long-term investments include the purchase of machinery, replacement of old machinery with a new one, new plant, and products, research process, etc. On the other hand, it is the process of allocation of resources for investment.

2. Capital Structure:

The combination of debt and equity is called capital structure. Capital structure is used by businesses or companies to provide funds for their operations and development.

3. Working Capital Management:

A business strategy is designed to make sure that the company operates its activities efficiently. Companies monitor how effectively they use their current assets and liabilities to achieve their goals.

Functions of Financial Management:

Financial managers plan for the future by understanding the cash flows and financial goals of the company or business, which is called financial management.

Some functions of financial management are:

1. Financial Planning and Forecasting:

In financial management, financial managers are responsible for financial planning. On the other hand, financial planning is an estimation of required capital and determining its composition. Consequently, they have financial policies related to procurement, investments, and administration of funds. Likely, it can be done for budget, expenditures, and future savings. Capitals are used in different projects for example for starting a new business, purchase of new assets, etc.

Financial forecasting is a process in which managers forecast or estimate the amount of capital they need to run the operations.

It includes:

- Identification of required capital

In financial management, financial managers make a clear estimate of capital requirements. It depends on expected costs and profits. Different policies are made to estimate the capital.

- Determine the capital structure

After deciding on the capital estimation financial managers determine the capital composition. This includes both short-term and long-term.

2. Cash Management:

In financial management, the important function is cash management. For example, financial managers take decisions that are linked to cash or capital. Further, they focus on how to spend the capital. In addition to business, cash is required for many purposes like salaries of employees, purchase of new machinery, equipment, and inventory, payment of electricity bills, payments for creditors, maintenance purposes, etc.

3. Estimation of Capital Expenses:

In financial management, companies estimate expenses in the following ways. Moreover, companies have to do promotions to improve their business. For instance, this is the most expensive task for companies. For this purpose, a lot of money or capital is required to promote any business. Furthermore, financial managers required investments that are used to promote their products. Consequently, companies have to make proper estimations for the purchase of assets like machines, equipment, lands, and buildings. Finally, financial managers have to make a complete estimation of the total capital required.

4. Procurement of Funds:

One of the core functions of financial management is the procurement of funds. Lastly, financial managers make decisions related to funds. And then how they will use them and from where they get the funds or capital. As a result, financial managers will get funds or capital.

5. Investment of Funds:

Managers or businesses need to make wise decisions related to investments of funds. Proper calculations related to risk and profits are made before investing. For this purpose, different tools are used to make an accurate analysis for investment. For this purpose, the tools are net profit value, returns on investments, etc.

6. Surplus Disposal:

The businesses after investment and expenditures focus on what to do with the surplus profit. Financial managers make wise decisions about whether they use the profit for investment purposes or divide the profit among partners as dividends.

7. Financial Control:

The financial managers control the funds. For this purpose, they use different techniques or methods to control the funds. The techniques are ratio analysis, cost, and profit control, etc.

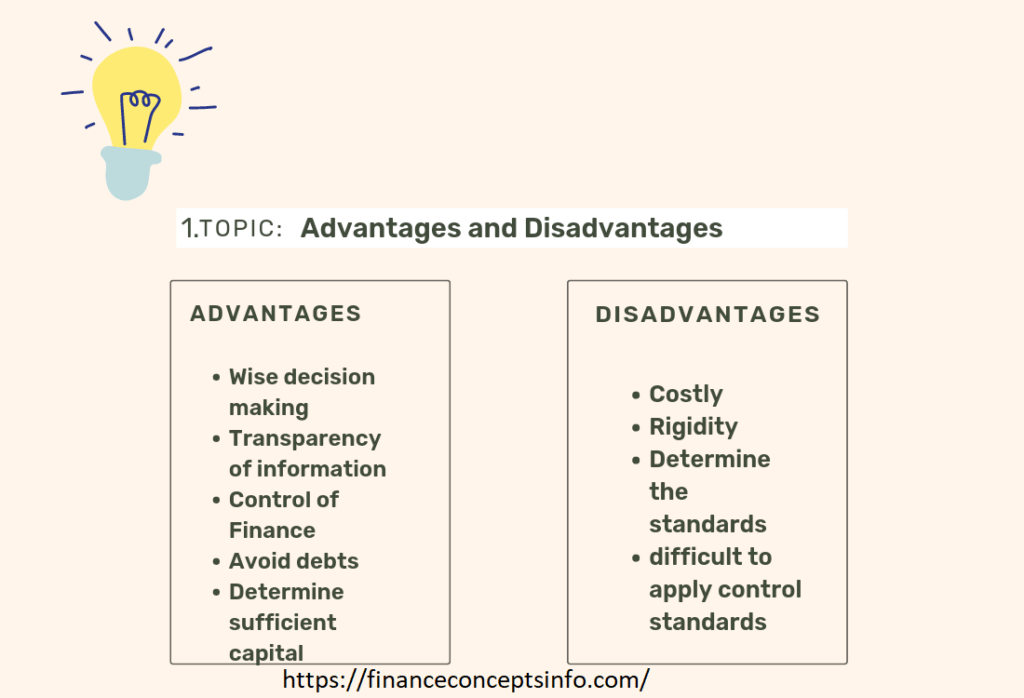

Advantages and Disadvantages of Financial Management:

Here are some advantages and disadvantages:

Advantages of Financial Management:

The advantages are:

- Wise decision making

In financial management, the most important thing is to make wise decisions. Similarly, financial managers have to collect and provide accurate information related to finance to the company. Finally, available information helps managers to make decisions on facts and figures.

- Transparency of information

Financial managers must keep all records of information and make it available to all employees, departments, and partners of the company. As a result, information transparency helps develop better awareness or knowledge inside and outside the company. Ultimately, it helps to avoid errors and confusion.

- Control of Finance

It helps in proper control of finance. Consequently, Financial managers confirm that all activities and operations are working in sequence with the estimated cost and within the given budget. And then supervise and manage all the activities of the business to handle financial control.

- Improve managerial efficiency

Financial Management guarantees that all financial activities are utilized efficiently. As a result, there is no wastage of resources. Moreover, financial Managers provide complete guidance and supervise all activities of employees to achieve the desired results.

- Determines sufficient capital

The most important task for managers is to estimate enough capital that is required for a business to carry out its operational activities. Financial management helps business to estimate the right amount of capital that they use to achieve their results.

- Avoid debts

It helps to avoid taking unnecessary debt for the company. The main objective is to utilize funds properly and efficiently that reduce the overall costs. This helps the managers to avoid any need for funds for business operations.

Disadvantages of Financial Management:

- Costly

It is a costly activity. Businesses required a lot of funds to implement financial control tools.

- Rigidity

In financial management, the managers lead rigidity by setting standards for measuring performance. The actual performance cannot be measured accurately because of rigidity standards.

- Difficult to apply control measures

In financial management financial control can only apply at the start of the process. But it becomes difficult during different operations of the process or activities.

- Determine the standards

Financial Management requires different standards that are used to measure performance. However, it is a very difficult task. Furthermore, there are no proper standards or methods to measure performance.

Ways to Improve Financial Management:

Effective financial management plays an essential role in the growth and survival of the business. Likewise, it helps businesses and companies to make effective use of resources, fulfill the needs and wants of stakeholders, increase competitive advantages, and maintain long-term stability.

We Use Some Ways to Improve Financial Management:

- Clear business plan

Every company or business must have a clear business plan. Besides proper planning, companies can not achieve their desired goals. Consequently, in their plans, they focus on where they are and where they want to be in the next year. Finally, they must plan all activities like what money they need and how they invest in their activities.

- Monitoring the financial position

Financial managers monitor the growth of their business daily. However, they must know how much money they have and how much they invest in the business.

- Ensure payments of customers

Today the major issue that a business faces is late or no payment from customers. Due to this reason, businesses can face many problems. So a proper computerized credit system helps businesses to keep complete track of customers’ accounts.

- Control day-to-day costs

In this, managers keep their eyes on cash flow as well and they measure cash in the business. Due to this, there must be enough cash to cover the day-to-day activities of the business. In spite of this, if cash is not available for everyday activities then a business cannot survive in the market. However, the daily activities are wages and rent.

- Get the right funding

For businesses, it is very important to choose the right type of finance. Similarly, each activity of business must be funded according to its nature and need.

- Stock control

Businesses need to have the right amount of stock accessible at the right time. Moreover, there must be a complete system that tracks the stock level. Further, this system helps you to keep an eye on your stock level plus helps you in the use of cash.

Tackle problems:

In businesses, the most difficult situation is dealing with a financial crisis. But they have professionals that give them guidance and enable them to overcome the situation. And then, financial managers must know how to improve cash flow management to tackle such problems throughout the process.