Income Statement vs. Balance Sheet:

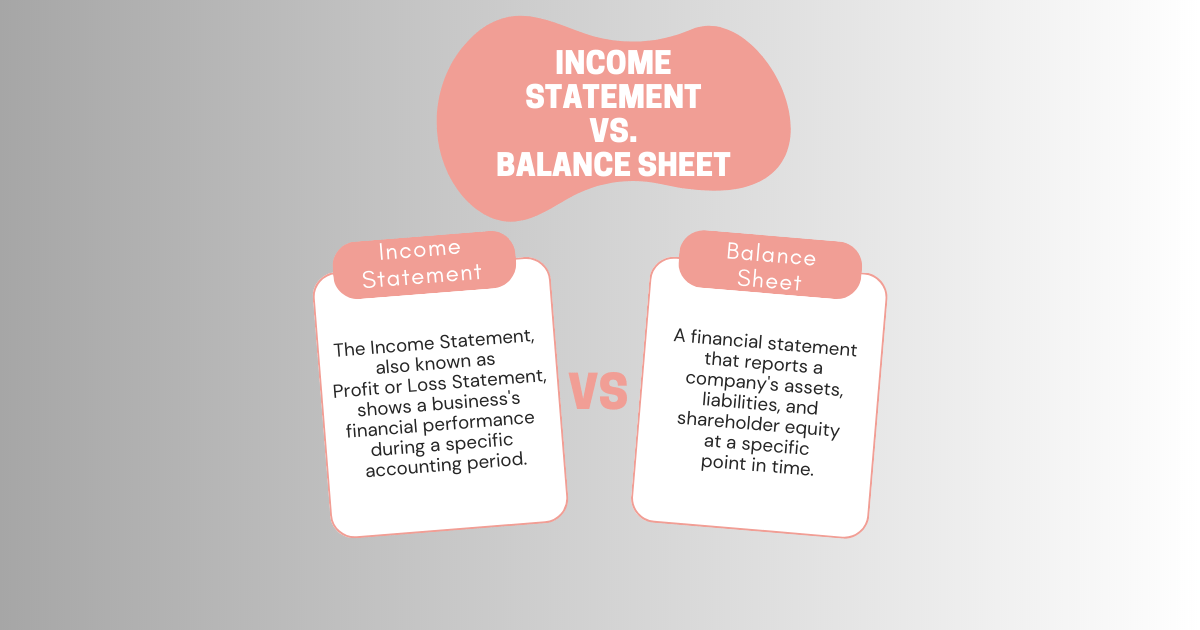

The income statement and balance sheet are two important financial statements that serve different purposes.

The income statement shows a company’s revenue, expenses, and profits over a specific period of time. The balance sheet summarizes a company’s assets, liabilities, and equity at a specific point in time.

It’s essential to understand the difference between these two statements.

Especially for anyone interested in a company’s financial performance, such as investors or analysts.

The most important thing to understand is the difference between the income statement and vs balance sheet.

It is not only for the business owner but all of the related members. For example, stakeholders make informed decisions about a company’s financial health.

This article is all about the difference and benefits between an Income statement and Vs. a Balance sheet.

Overview of the income statement, balance sheet, and cash flow statement:

Let’s have a look at the three primary financial statements that companies use. These three financial performances are the income statement, balance sheet, and cash flow statement.

Income Statement:

The income statement is also called the profit and loss statement. It actually shows a company’s revenue, expenses, gains, and losses over a specific period.

Moreover, the income statement helps analyze company profits. And understand how much profit a company has made during that period.

The purpose of the Income Statement is to show how much a company has generated during a given period. Additionally, it also shows how much it has spent to generate that income.

The Income Statement provides information about a company’s advantage. So, investors and lenders can use it to calculate a company’s accounting health.

The income statement consists of three parts which are:

- Revenue

2. Expenses

3. Net income

The money earned from sales, minus its total expenses, like salaries, rent, and other costs.

The result is the net income, which is the company’s profit or loss for that period. Net income is the difference between income and expenses.

Furthermore, it represents the profit or loss generated by a company during a specific period.

An example of an Income statement shows the company’s period return generated. Expenses earned to generate that profit follow afterward.

The final line of the Income Statement would Net income line showing the company’s profit/loss period.

Show the net income, which represents the company’s profit or loss for the period.

Balance sheet:

The balance sheet represents the report of the company’s banking position and annual accounting period.

The purpose of it is to provide information about a company’s money health and stability. Additionally, the financial statement informs stakeholders about future decisions.

The balance sheet consists of three parts:

1. Assets

2. Liabilities

3. Equity

Cash Flow Statement:

The Cash Flow Statement shows the inflows and outflows of cash within a company over a specific period. This is a way to check if a company has enough money or assets to pay for its expenses and debts.

Moreover, it helps to see if the company is financially stable and can handle its financial responsibilities.

Hence, all three statements are important for shareholders to make informed decisions about a company’s future prospects.

What are the differences between a balance sheet and an income statement?

Income Statement

Presents the revenues, expenses, gains, and losses of the company during the period.

Shows a company’s financial performance over a period, usually a year or a quarter.

Reflects the company’s ability to generate income and manage costs in the short term.

Provides information for calculating financial ratios. Such as earnings per share (EPS), profit margin, and return on assets (ROA).

Balance Sheet

Presents the assets, liabilities, and equity of the company at the reporting date.

Calculates the total assets of the company, which must equal the total liabilities and equity.

Helps investors, analysts, and other stakeholders evaluate the solvency and liquidity of the company.

Reflects the company’s ability to meet its financial obligations and manage its resources in the long term.

Comparison of income statement vs. balances sheet vs. cash flow:

- The income statement only reflects a company’s financial performance over a specific period of time.

However, it does not provide any information about a company’s assets, liabilities, or cash flow.

- The balance sheet provides a snapshot of a company’s financial position at a specific point. Furthermore, it also shows a company’s assets, liabilities, and equity.

- The cash flow statement provides information about a company’s sources. It tells the uses of cash, including cash received from customers, cash paid to suppliers, and cash received from loans or paid out as dividends.

- Each statement presents unique information. Therefore, using income statement, balance sheet and cash flow statements provide a comprehensive understanding of a company’s financial health.

Consequently, stakeholders need to analyze and interpret the difference between the income statement and balance sheet in order to make informed decisions.

Conclusion:

It’s essential to understand the differences and benefits between the income statement and balance sheet.

By analyzing these two financial statements, investors and analysts can gain a detailed understanding of a company’s financial health and performance.

Furthermore, the income statement provides information about a company’s revenue, expenses, gains, and losses over a specific period of time.

While the balance sheet summarizes a company’s assets, liabilities, and equity at a specific time.

Hence, income statement and balance sheet can reveal critical insights into a company’s profitability, liquidity, and financial stability, making them vital tools for making informed investment decisions.