What is Capital Allocation?

Capital allocation is a method through which a company chooses to invest its funds. Its primary objective is to increase profits for shareholders. It’s a significant financial decision taken by the CEO and CFO together. They decide how and where the company will invest its profits. Therefore, it’s an essential step for a business’s long-term success.

The executive teams evaluate potential investment opportunities. Here are some of the possible options:

- Returning capital to shareholders as dividends

- Re-buying the stock shares

- Issuing a special dividend

- Expanding the budget for research and development

These are just a few of the potential alternatives. Moreover, the company could also choose to put money into growth projects. This includes spending money on acquisitions and internal growth.

Why Is Capital Allocation Important?

There are a number of ways to create value. However, analyzing all the opportunities before making any decision is wise. Capital allocation is the procedure that implements a company’s financial strategy. When implemented correctly, it enables business leaders to optimize earnings. This will ultimately raise its market value.

However, if funds are not allocated properly, it can be risky. It may cause the company and its shareholders to miss valuable chances. Furthermore, it is a huge responsibility. A company’s performance depends on finance leadership’s capital allocation choices. It can have a big impact on long-term investment gains.

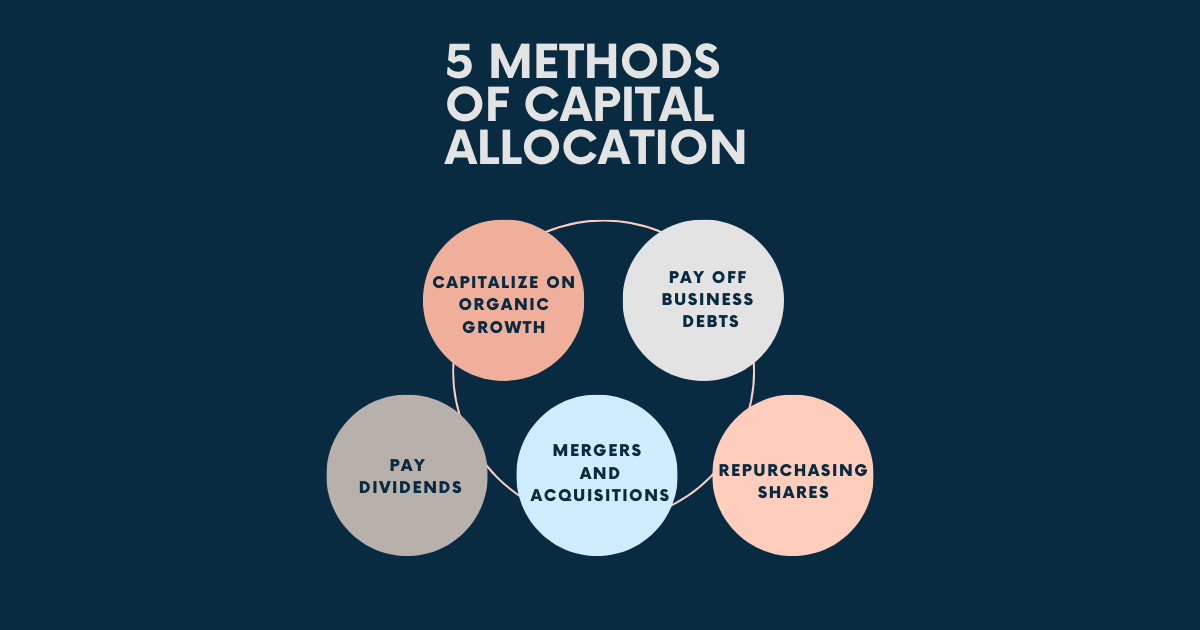

Capital Allocation Methods:

There are various approaches to allocating capital properly. Here are some frequently used methods by business leaders. These methods help them prepare their company for long-term success.

Capitalize on Organic Growth:

Organic growth means that a company uses its own resources to grow its business. When a company focuses on organic growth, it improves internal operations. The business also comes up with new products and moves resources to different departments. In either case, investing in organic growth is a wise move.

Investing in organic growth means you’re putting money into your future. This gives your business the resources it needs to thrive. However, remember that this is a long-term method. So, it will not show any significant effects right away. Furthermore, the leaders of a company track their organic growth by analyzing annual sales.

Pay off Business Debts:

Debt management is crucial for businesses. You can find this accounting data in your business records. The ability to read and understand accounting records is important for leaders. Thus, they can estimate the company’s debts and suggest ways to settle them.

Businesses can pay down debt by using extra cash. That will improve the debt-to-equity ratio. Furthermore, it will guarantee the company’s growth and well-being. If a company has spare funds, it should pay its debts. That’s because businesses can already predict the return on returned debt.

Pay Dividends:

Dividends are a capital allocation option for publicly traded firms. Profits are then distributed to stockholders. Additionally, the board of directors is responsible for setting this figure. It can lead to a corresponding change in stock price.

Dividends are useful when there are no clear options for investing capital. Investors like dividends because they give stockholders free cash flow. This encourages more investment within the company. Moreover, a company’s ability to pay dividends is also a sign of its economic stability.

Mergers and Acquisitions:

Acquisitions and mergers carry a great deal of risk with them. However, it has the best potential to add economic and strategic value to a rising business. It allows the company to reach new markets and make more money. Furthermore, it enables them to use better resources and talents. This allows companies to get an advantage over others in the market.

However, this may be the riskiest capital allocation method of all. Serious risks include overpaying, lack of diligence, or integration issues.

Repurchase Shares:

Buying back the company’s own shares is the final option for allocating capital. A company can improve the value of its shares by decreasing the number of shares on the market. Shareholders will receive a tax-efficient return.

Additionally, a firm can repurchase its stock through an open market or a tender offer. It’s an offering to stakeholders to sell a few of their shares within a term. People often see a company’s share buyback as a good sign of its success. Hence, the value of stock prices also increases.

What Is Capital Allocation Line?

The capital allocation line represents all possible configurations of risky and safe assets. The investor can select the ideal balance of risky and safe assets with this line. When building a portfolio, every investor faces an issue with how to allocate risky and risk-free assets. They try to achieve the highest profits with the lowest amount of risk.

So, investors can estimate this allocation ratio using the capital allocation line. It helps find the optimal combination of risky and risk-free returns. Consequently, there are maximum profits with little risk.

Building Factors of a Capital Allocation Line:

Consider the following factors to calculate a capital allocation line:

Portfolio Risk:

The portfolio’s risk is proportional to the risky asset’s weight. Assets that carry no risk are risk-free. Hence, the risk component would be zero.

Weights of the Assets in the Portfolio:

The proportion mix of risky and risk-free assets in a portfolio.

Expected Return of the Portfolio:

It is determined by factoring in the projected return of risky and risk-free assets while analyzing the risk in the portfolio.

What Is Capital Allocation Line Formula?

The formula of the Capital Allocation Line is as follows:

Ep = rf + [ E(rs – rf)/ σs ] * σp

Here,

Ep stands for the expected return of the portfolio

E(rs) stands for the expected return of the risky asset

W stands for the weight of the risky asset in the portfolio

E(rf) stands for the expected return of the risk-free asset

What Impact Does Capital Allocation Have?

Capital allocation is a beneficial approach for a company’s success. It shows a company is stable, prosperous, and worthy of investment. Moreover, it boosts the returns to shareholders. Therefore, capital allocation is a key factor that investors should not overlook. It may be very beneficial for the industry and the company.

Poor strategic capital allocation decisions can have harmful impacts. They include a lower equity return, reduced stock prices, and slow growth. However, proper capital allocation can save your business and set it on the path to success.